“

The views expressed in this blog are solely those of the National Taxpayer Advocate.

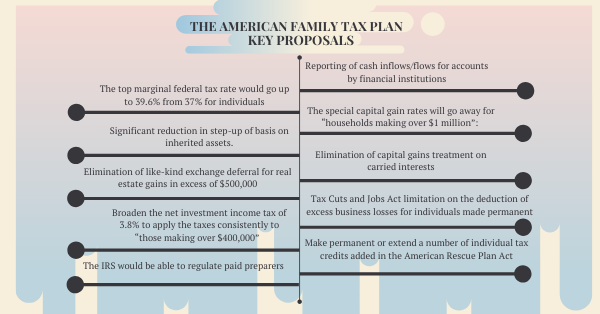

Note from the Editor: while we normally do not comment on proposed legislation, there are some significant changes proposed for your high wealth clients.

The IRS will automatically refund money to people who filed their tax returns reporting 2020 unemployment compensation before the recent changes made by the

MEMORANDUM FOR ALL SERVICES AND ENFORCEMENT EMPLOYEES

FROM: Sunita Lough

Deputy Commissioner for Services and Enforcement

The American Rescue Plan Act (ARPA), which was signed into law on March 11, 2021, included funding for the RRF which is administered through the Small Business Administration (SBA).

A new safe harbor allows “covered taxpayers” to elect to deduct expenses paid for with a Paycheck Protection Program (PPP) loan that they did not deduct due to IRS guidance issued prior to the pass

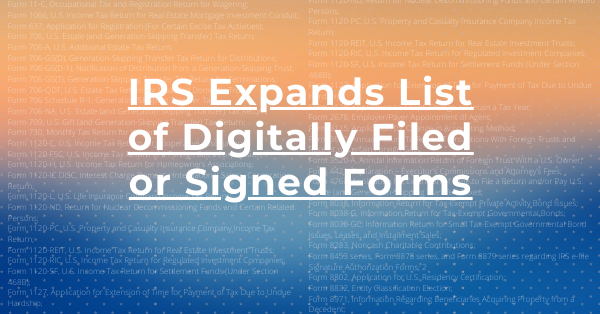

Attention: Return Transmitters and Authorized IRS e-file Providers/EROs

NTA Blog: Did You File a Superseding Return? If So, Read On