The American Family Tax Plan

Note from the Editor: while we normally do not comment on proposed legislation, there are some significant changes proposed for your high wealth clients. This article is provided to prepare you for comments from clients regarding proposed changes to their tax planning. This proposed legislation still needs to go through the Congressional process and many changes can (and probably will) be made before the final legislation is sent to the President for signature.

The full White House Briefing paper is available here.

Key Proposals

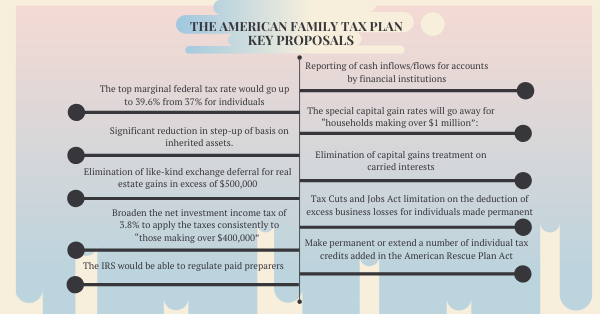

A summary of some of the key proposals is found below.

- Reporting of cash inflows/flows for accounts by financial institutions: As part of a focus on increasing tax enforcement activities against higher income taxpayers, the law would add a provision that “would require financial institutions to report information on account flows so that earnings from investments and business activity are subject to reporting more like wages already are.”

- The top marginal federal tax rate would go up to 39.6% from 37% for individuals: The proposal would restore the top marginal individual income tax rate to 39.6%. The fact sheet states: “The President’s plan restores the top tax bracket to what it was before the 2017 law, returning the rate to 39.6 percent, applying only to those within the top one percent.”

- The special capital gain rates will go away for “households making over $1 million”: One of the items that got immediate notice was the elimination of the lower rate on long term capital gains for certain taxpayers. It is not clear if that is based on adjusted gross income, taxable income, or some other measure. The fact sheet states “[h]ouseholds making over $1 million—the top 0.3 percent of all households—will pay the same 39.6 percent rate on all their income, equalizing the rate paid on investment returns and wages.”

- Significant reduction in step-up of basis on inherited assets. Potentially far more significant is the apparent taxation of excess appreciation in assets held when a person dies. The fact sheet provides: “Today, our tax laws allow these accumulated gains to be passed down across generations untaxed, exacerbating inequality. The President’s plan will close this loophole, ending the practice of “stepping-up” the basis for gains in excess of $1 million ($2.5 million per couple when combined with existing real estate exemptions) and making sure the gains are taxed if the property is not donated to charity.”

- Elimination of capital gains treatment on carried interests: An issue that was heavily discussed during the process of passing the Tax Cuts and Jobs Act is also raised in the fact sheet. While it had been proposed originally as part of TCJA to force income from carried interests to be taxed as ordinary income, the provision was watered down substantially in the final version of TCJA. Now the new Administration apparently wants to try again to change the tax treatment of such income. The fact sheet states: “The President is also calling on Congress to close the carried interest loophole so that hedge fund partners will pay ordinary income rates on their income just like every other worker. While equalizing tax rates on wages and capital gains will address this disparity, permanently eliminating carried interest is an important structural change that is necessary to ensure that we have a tax code that treats all workers fairly.”

- Elimination of like-kind exchange deferral for real estate gains in excess of $500,000. The Tax Cuts and Jobs Act eliminated like-kind exchange treatment for any assets aside from real estate held for income producing or business purposes. The new proposal would again reduce the number of transactions eligible for like-kind exchange deferral treatment, providing: “The President would also end the special real estate tax break—that allows real estate investors to defer taxation when they exchange property—for gains greater than $500,000...”

- Tax Cuts and Jobs Act limitation on the deduction of excess business losses for individuals made permanent. The fact sheet provides “…the President would also permanently extend the current limitation in place that restricts large, excess business losses, 80 percent of which benefits those making over $1 million.”

- Broaden the net investment income tax of 3.8% to apply the taxes consistently to “those making over $400,000.” The fact sheet provides that “Finally, high-income workers and investors generally pay a 3.8 percent Medicare tax on their earnings, but the application is inconsistent across taxpayers due to holes in the law. The President’s tax reform would apply the taxes consistently to those making over $400,000, ensuring that all high-income Americans pay the same Medicare taxes.” This seems to insure that income in excess of $400,000 would be either subjected to Medicare taxes or the net investment income tax. Currently if a person is actively involved in an S corporation, any flow-through income the person receives from the S corporation is not subject to either Medicare taxes or the net investment income tax.

- The IRS would be able to regulate paid preparers. The fact sheet also provides that the IRS would be able to regulate paid tax return preparers. The sheet states: “Tax returns prepared by certain types of preparers have high error rates. These preparers charge taxpayers large fees while exposing them to costly audits. As preparers play a crucial role in tax administration, and will be key to helping many taxpayers claim the newly-expanded credits, IRS oversight of tax preparers is needed. The President is calling on Congress to pass bipartisan legislation that will give the IRS that authority.”

- Make permanent or extend a number of individual tax credits added in the American Rescue Plan Act. The proposal looks to make permanent or significantly extend a number of new individual tax credits that were added on a temporary basis in the American Rescue Plan Act of 2021. These provisions include:

- Extend expanded ACA premiums tax credits in the American Rescue Plan

- Extend the Child Tax Credit increases in the American Rescue Plan through 2025 and make the Child Tax Credit permanently fully refundable.

- Permanently increase tax credits to support families with child care needs (the credit for child care).

- Make the Earned Income Tax Credit Expansion for childless workers permanent.