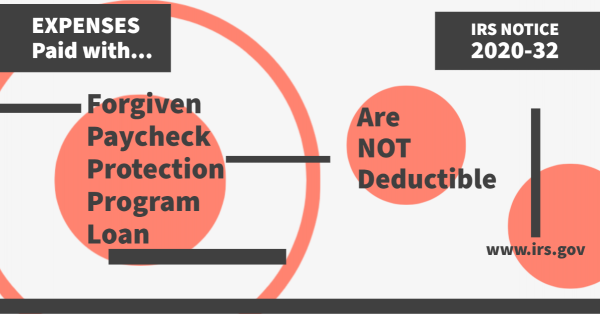

In Notice 2020-32, the IRS has clarified that no deduction is a

The IRS has posted information regarding the employee retention credit on their website here.

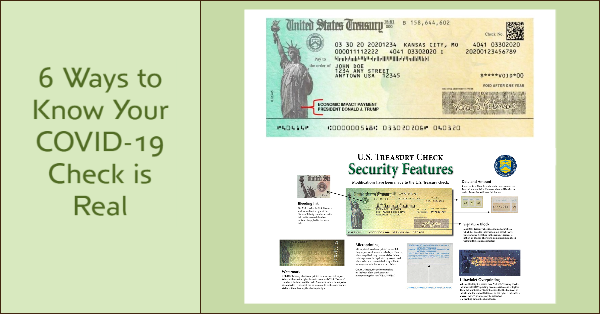

The Internal Revenue Service has been making good progress in getting the economic impact payment to eligible individuals.

The Internal Revenue Service announced, on Sunday, April 26th, significant enhancements to the “Get My Payment” tool to deliver an improved and smoother experience for Americans eligible to receive

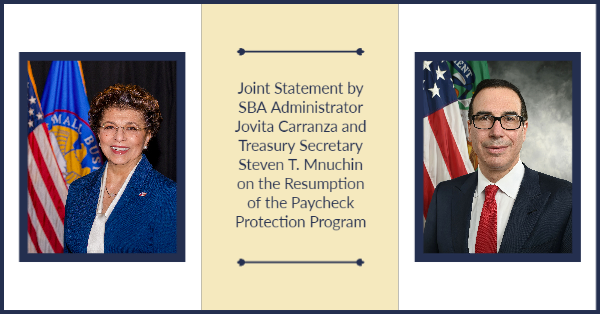

“We are pleased that President Trump has signed into law the Paycheck Protection Program and Health Care Enhancement Act, which provides critical additional funding for American workers and small b

For businesses with employees the IRS has provided for three situations where the payroll tax deposits held in escrow can be used to provide for mandated employee pay or to provide for business ope

The Treasury Department and the Internal Revenue Service (IRS) have released a new web tool that will allow taxpayers to updat

(From dontmesswithtaxes.com) The Internal Revenue Service is beginning the process of sending out economic relief payments.

The IRS issued notice Monday, April 13, 2020 that IRS operations to process third-party authorizations is now closed.