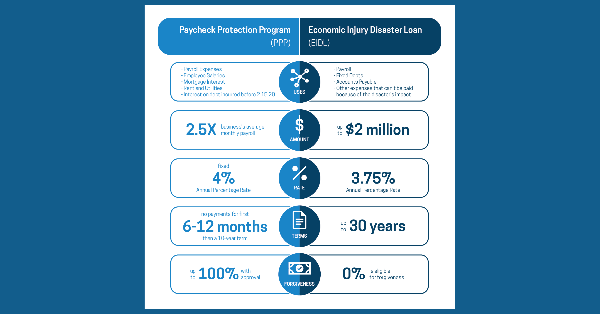

As of this writing there are two provisions to help American businesses and their employees as a result of the coronavirus. The first action was introduced by the U.S.

The CARES Act (Coronavirus Aid, Relief, and Economic Security Act) consists of about 880 pages touching every industry.

To help people facing the challenges of COVID-19 issues, the Internal Revenue Service announced a

The U.S.

“I want you to hear directly from me how the COVID-19 pandemic is affecting our services. The first thing you should know is that we continue to pay benefits.

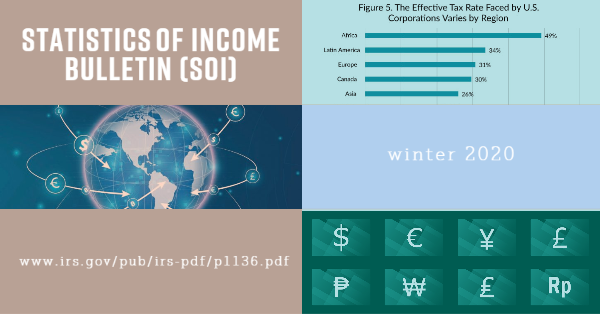

The Winter 2020 Statistics of Income Bulletin is now available on IRS.gov.

The IRS has created a new website, irs.gov/coronavirus, that, according to the IRS, is "focused on steps to help taxpayers, businesses and

The Internal Revenue Service announced it will visit more taxpayers who have not filed tax returns for prior years in an effort to increase tax compliance and further enforce the law.