TAXPAYER NAME ORDER MATTERS ON FORM 1040:

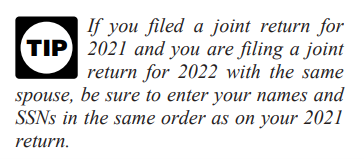

A directive from the IRS instructions for the Form 1040, indicates that a taxpayer enters the names and Social Security numbers of the taxpayers in the same order as in the previous year.

So, if the husband's name was first on the 2022 return (or the 2021 return, as noted in the joint filing tip above from the Form 1040 instructions for the current tax season), it should also be listed first on the 2023 return filed next year. Or vice versa. The Internal Revenue Service return filing data shows that on 1040 forms filed jointly in 2020 by heterosexual couples, men are listed first on the form most of time. In fact, almost all the time. Numerically speaking, 88 percent of the time.

Changing the order could confuse the agency, which already has your tax data shown one way. And that could possibly lead to delays in the IRS' processing of your joint return.

Who is first on the 1040: The National Bureau of Economic Research (NBER) paper Who's on (the 1040) First? Determinants and Consequences of Spouses' Name Order on Joint Returns provides an analysis of the order of the spouses on the tax return.

Here are some highlights:

- Whose name goes first has absolutely no impact on tax liability, so in one sense it does not matter at all. But the name order by gender is undeniably non-random.

- The man's name is more likely to go first when most of the couple's income is earned by him.

- It's also seen more among older joint filers.

- Based on state averages, putting the man's name first is strongly associated with conservative political attitudes, religiosity, and a survey-based measure of sexist attitudes.

- While the 88 percent total of men's names listed first on a joint 1040 filing in 2020 is a lot, that trend has been declining. Men were listed as the first filer 97.3 percent in 1996, the first year the first year the NBER authors were able to measure the name listings.

- An appendix table, State-Level Male-Name-First Fraction, at the end of the report show that the listing of the man's name has declined over the 24 years studied across all states and the District of Columbia.

- The 2020 tax year data shows Iowa filers are the most inclined to list the husband's name first, with 90.7 percent doing so. Joint husband-wife taxpayers in Washington, D.C., are the most egalitarian, with the man's name listed first just 79.7 percent of the time. District filers were the only ones to fall below 80 percent.