FARMERS & RANCHERS IN 49 STATES GET DROUGHT TAX RELIEF:

The lack of rain nationwide has led to stunted crops and, in dire cases, forced farmers to abandon fields. Ranchers have had sell their livestock sooner than they expected and for lower prices since the feed crops upon which the animals depend also are affected.

It has been a major financial and tax problem for cattle ranchers and others whose livelihoods depend on raising animals for market. By selling the animals, they triggered potential capital gains taxes. But the Internal Revenue Service is offering some livestock owners relief.

The agency late last month reminded eligible farmers and ranchers forced to sell livestock due to drought that they may have an extended period of time in which to replace the livestock and defer tax on any gains from the forced sales.

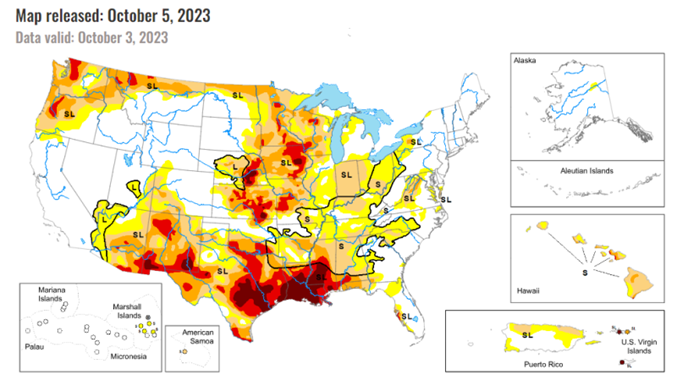

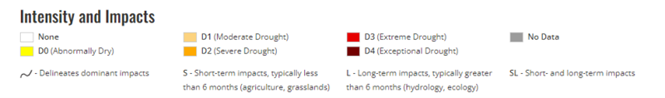

The extension of an additional year applies to eligible farmers and ranchers who qualified for the four-year, instead of two-year, replacement period, if they are in a region listed by the National Drought Mitigation Center as suffering exceptional, extreme, or severe drought conditions during any week between September 1, 2022, and August 31, 2023.

Latest drought conditions in the United States. Map via U.S. Drought Monitor. United States and Puerto Rico Map Author: Brad Pugh, NOAA/CPC; Pacific Islands and Virgin Islands Author: Curtis Riganti, National Drought Mitigation Center.

The four-year replacement period means that the extension impacts drought sales that occurred during 2019. The replacement periods for some drought sales before 2019 are also affected due to previous drought-related extensions affecting some of these localities.

Due to the drought tax year time shifting, eligible farmers and ranchers whose drought-sale replacement period was scheduled to expire on December 31, 2023, now have, in most cases, until the end of the 2024 tax year to replace the sold livestock.

The IRS points out that this relief generally applies to capital gains realized by eligible farmers and ranchers on sales of livestock held for draft, dairy, or breeding purposes. The IRS notes that it might further extend this replacement period if the drought continues.

Sales of other livestock, such as those raised for slaughter or held for sporting purposes, or poultry, do not qualify.

Because of the extent of the drought, the extension applies to 49 states, the only state exempted from this tax relief is Alaska. In addition, the tax relief has been granted to ranchers and farmers in the District of Columbia, as well as in two U.S. territories and two independent nations in a Compact of Free Association with the United States.