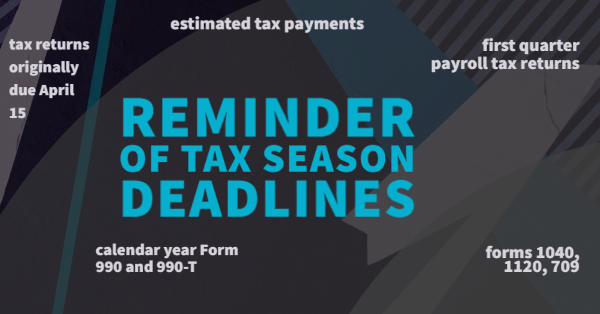

With all of the changes resulting from the coronavirus it is easy to get lost in the fact that we are still trying to squeeze in tax returns with all of the challenges of working from home (WFH), c

To help taxpayers and the tax professional community during this COVID-19 period, effective immediately, the IRS will begin temporarily accepting images of signatures (scanned or photographed) and

The IRS Commissioner, Charles Rettig, recently contacted tax professional groups with an appeal for help from the nation’s tax professionals.

From the editor: And the week would not be complete without the usual warning from the IRS regarding scams trying to get taxpayer bank information under the ruse o

While all the chatter is about the stimulus payments and the loan programs available for the small business owner there were also many tax provisions that were included in the CARES Act:

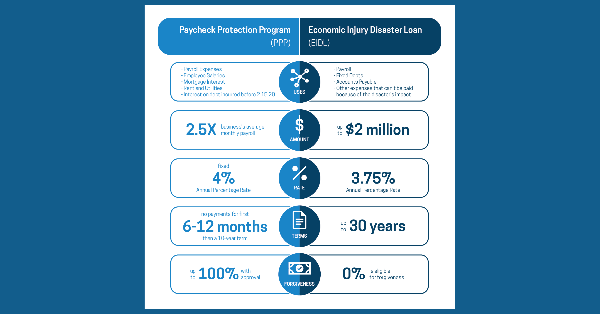

As of this writing there are two provisions to help American businesses and their employees as a result of the coronavirus. The first action was introduced by the U.S.