IRS SEEKING VITA AND TCE VOLUNTEERS FOR 2023 TAX SEASON:

The IRS and its community partners are recruiting people to be a part of the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs during the coming 2023 tax season.

Free help for certain needy filers: VITA and TCE volunteers have helped millions of low-to-moderate income and older taxpayers meet their annual tax return filing obligations.

VITA volunteers have been offering free tax assistance for more than 50 years. Eligible taxpayers are those making less than a certain income level; the latest earnings cut-off was $58,000.

Persons with disabilities, as well as those whose native language is not English, also are welcome to get help at VITA sites.

The TCE program also offers free tax help to those who are age 60 and older. TCE volunteers specializing in questions about pensions and retirement-related issues unique to seniors.

Volunteer, but trained: The IRS manages the VITA and TCE programs, but the various sites across the United States are operated by IRS partners and volunteers. And while those helping complete tax returns are volunteers, they also are certified by the IRS.

All VITA and TCE volunteers who prepare returns must take and pass tax law training that meets or exceeds IRS standards. This training includes maintaining the privacy and confidentiality of all taxpayer information.

In addition to ensuring that VITA and TCE volunteers are knowledgeable about tax laws, the IRS requires a quality review check for every return prepared at a VITA or TCE site before it is electronically filed.

Help in person…: In their original formats, VITA and TCE sites offer face-to-face tax preparation under the auspices of community groups that work with the IRS. The tax help sites usually are in community centers, senior citizen groups' facilities, or other public locations.

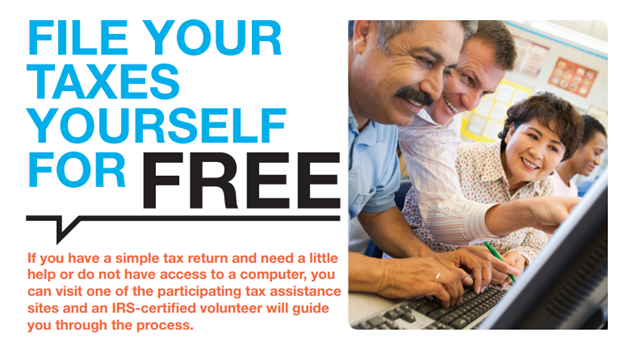

Tax volunteers also assist taxpayers with tax preparation at thousands of Facilitated Self-Assistance sites. Here, taxpayers who have simple tax returns but still need just a little help can fill out their returns on their own, with an IRS-certified volunteer available to offer guidance if you hit a snag in the filing process.

You can find out more about Facilitated Self-Assistance and a nearby VITA site that can help you do your own taxes in IRS Publication 4974.

…or online: When safety protocols required to deal with the COVID-19 pandemic disrupted such in-person assistance, VITA and TCE went virtual. That's was so successful that volunteer tax prep operations across the country have expanded their virtual volunteering options.

With the virtual VITA/TCE option, you can help your neighbors and community from the comfort of your home if that's what you prefer.

Sign up now: If you're interested in being a VITA or TCE volunteers, then let the IRS know by going to its VITA/TCE Volunteer and Partner Sign Up webpage.

When, how you can help: VITA and TCE sites usually are open from late January through the tax filing deadline in April. Some sites are open all year. In many cases, volunteering is flexible, with VITA and TCE assistors generally allowed to choose their own hours and days to work at the sites.

You also have choices of how you can best help. VITA and TCE roles include —

- Greeter/Screener – You greet everyone visiting the site to create a pleasant atmosphere. You screen taxpayers to determine the type of assistance they need and confirm they have the necessary documents to complete their tax returns. Tax law certification is not required for this position.

- Interpreter – You provide free language interpreter services to customers who are not fluent in English. Basic tax knowledge is helpful, but it is not required for this position.

- Site Administrator/Coordinator – You have excellent organizational and leadership skills. You are the primary resource for sharing your knowledge of the program and are available to assist with any issues that may arise. You develop and maintain schedules for all volunteers to ensure adequate coverage, supplies and equipment at your site. Tax law certification is not always required for this position.

- Tax Preparer – You complete and successfully certify in tax law training, including the use of electronic filing software, to provide free tax return preparation for eligible taxpayers.

- Quality Reviewer – You review tax returns completed by volunteer tax preparers, ensuring that every taxpayer receives top quality service and that the tax returns are error-free. You must be tax law certified at least at the Intermediate level.

- Computer Specialist or troubleshooter– You have a working knowledge of personal computers, software and communications systems. Tax law certification is not required for this position. If working at a self-prepare site you must become familiar with the various tax software option(s) available at your site. Although you may have less taxpayer interaction than most volunteers, you must be patient with those individuals who may not be as computer literate.

- Tax Coach – You provide tax law assistance and guide taxpayers in preparing their own tax returns. Tax law certification is required for this volunteer role and training is available on-line or through face-to-face instruction. o-face instruction.

- Instructor — -Once you complete online certification in tax law at the advanced level or higher and familiarize yourself with any software updates, you can train other volunteers. The classes you'll lead will be in a classroom setting or online.

- Marketing — If marketing is your métier, then VITA and TCE can use your skills. Many site partners would love to use your expertise to get the word about their tax-preparation locations to the community.

The IRS stresses that they are looking for volunteers from all backgrounds and of all ages, as well as individuals who are fluent in other languages.