IRS FLAGS 1.1 MILLION POSSIBLY FRAUDULENT TAX RETURNS, STOPS $105.3 MILLION IN ILLEGAL REFUNDS:

IRS FLAGS 1.1 MILLION POSSIBLY FRAUDULENT TAX RETURNS, STOPS $105.3 MILLION IN ILLEGAL REFUNDS:

A Treasury Inspector General for Tax Administration (TIGTA) report on the early results of the 2023 filing season shows that the agency is still taking identity theft seriously.

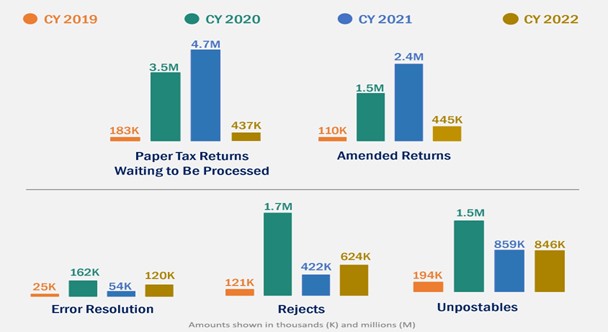

This filing season, was the first since the pandemic began where individual tax return processing and related activities returned for the most part to normal timelines, noted TIGTA. As of March 3, the IRS had received 54.9 million tax returns, or almost a third of the 167 million filings it expects to get this year.

Source: IRS Filing Season Statistics for the week ending December 28, 2019; IRS inventory numbers provided to the Treasury Inspector General for Tax Administration (TIGTA) for the weeks ending December 25, 2020, December 31, 2021, and December 30, 2022; and the Customer Account Services Form 1040X Consolidated Inventory Report for the weeks ending December 28, 2019, December 26, 2020, January 1, 2022, and December 31, 2022. CY = Calendar Year.

Of that nearly 55 million, TIGTA says the IRS had identified nearly 1.1 million tax returns it held for additional review due to the agency's identity theft filters. Those filings were for refunds totaling approximately $6.3 billion.

Ahead of 2022: By that same early March date, the IRS had confirmed 12,617 tax returns were fraudulent and did not issue the $105.3 million in refunds illegally claimed by those fake filings.

Already this year, the IRS is ahead of 2022's early filing season pace in stopping crooks from filing fake returns to get fraudulent refunds.

|

Identity Theft Tax Returns Confirmed Fraudulent in Processing Years 2022 and 2023 |

|

|

Processing year |

Confirmed ID theft returns |

|

2022 |

9,626 |

|

2023 |

12,617 |

|

Source: IRS fraudulent tax return statistics for Processing Year 2022 (as of March 3, 2022) and Processing Year 2023 (as of March 2, 2023) |

More fraud filters: This year's success is due to the 236 filters the IRS is using to identify potential identity theft tax returns and stop fraudulent refunds. In comparison, the IRS used 168 filters for the 2022 Filing Season.

While the fraud filters can slow processing of legitimate returns, they are the best tool the IRS has to keep from issuing money to criminals who are impersonating taxpayers.

Expansion of the automated Error Resolution correction tool: The IRS implemented an automated Error Resolution correction tool during the 2022 Filing Season in an effort to shorten the time needed to resolve certain taxpayer errors that could delay their refund as well as to reduce the risk of IRS employee error. The IRS refers to this tool as the FixERS tool. This tool systemically replaces the steps an IRS Error Resolution employee would take to resolve the identified tax return errors. The IRS began using the FixERS tool to address common taxpayer errors when claiming the CTC, the EITC, the CDCC, and the RRC.

As part of the 2023 Filing Season, the IRS has expanded the FixERS tool to include 16 new error codes for a total of 21 error codes. These error codes were fully implemented for use by the FixERS tool during the week of March 6, 2023. As of March 31, 2023, the IRS reports that 1.4 million tax returns have been placed into production for the FixERS tool. From this population, 973,033 (69 percent) tax returns errors were resolved while 429,599 (31 percent) tax return errors could not be resolved by the tool and were resuspended for manual processing. Appendix IV of this report contains a complete list and description for the 21 error codes.